How It Works

Debt review is a legal process in South Africa that helps people who are over-indebted by restructuring their debt into more manageable payments:

The Process

01. Getting Started

Contact us for a free no-obligation consultation.

02. Asses & Review

We do an assessment of your income and expenses, including your current loan/debt repayments. This will determine if you are over-indebted.

03. Restructure & Negotiations

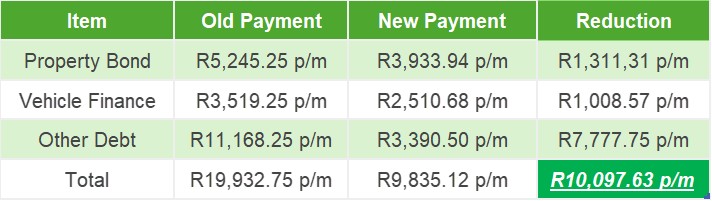

A new reduced payment plan is negotiated with more favourable terms with your creditors (reduced interest rate). This will be 1 single reduced payment for all your qualifying outstanding debts and loans, which we distribute to your creditors via an NCR approved Payment Distribution Agency (PDA).

04. Court Order Application

Our legal team will apply to the court to have you officially placed under the debt counselling programme which provides legal protection of your assets against creditors (homes and vehicles are protected from repossession), as well as any new judgments as long as you abide with the new approved reduced repayment plan.

05. Portfolio Management

We ensure payments received from you are distributed correctly to your creditors, that you keep your reduced repayment plan up to date as well as assist with any queries you may have while under the debt counselling process. NCR will notify all credit bureaus that you have applied for debt review to ensure you do not incur further credit whilst under the program.

06. You're Debt Free

We remove you from the debt counselling process once your debts have been repaid or the repayments are more manageable. We will apply for your clearance certificate ensuring that you no longer under debt counselling. Your improved credit record will allow access to apply for responsible credit in future again should you need to.